Enterprise Video Management

Take control of your video strategy with our enterprise solutionThe world’s most trusted and well-known brands rely on Qumu to deliver seamless video experiences that manage, secure and measure content.

Making Enterprise Video Smarter and Better to Suit Your Needs

The world’s most trusted and well-known brands rely on Qumu to deliver seamless video experiences that manage, secure and measure content.

Broadcast Live Events

Make live and recorded video easily accessible to all your audiences, regardless of size, while ensuring secure delivery and optimized performance for any network and device.

Create Engaging Interactive Videos

Whether from your desktop webcam, studio encoders, or video teleconference, capture video and enrich it with interactive features that drive engagement (subtitles, chapters, CTA, quizzes and more)

Manage & Secure Videos

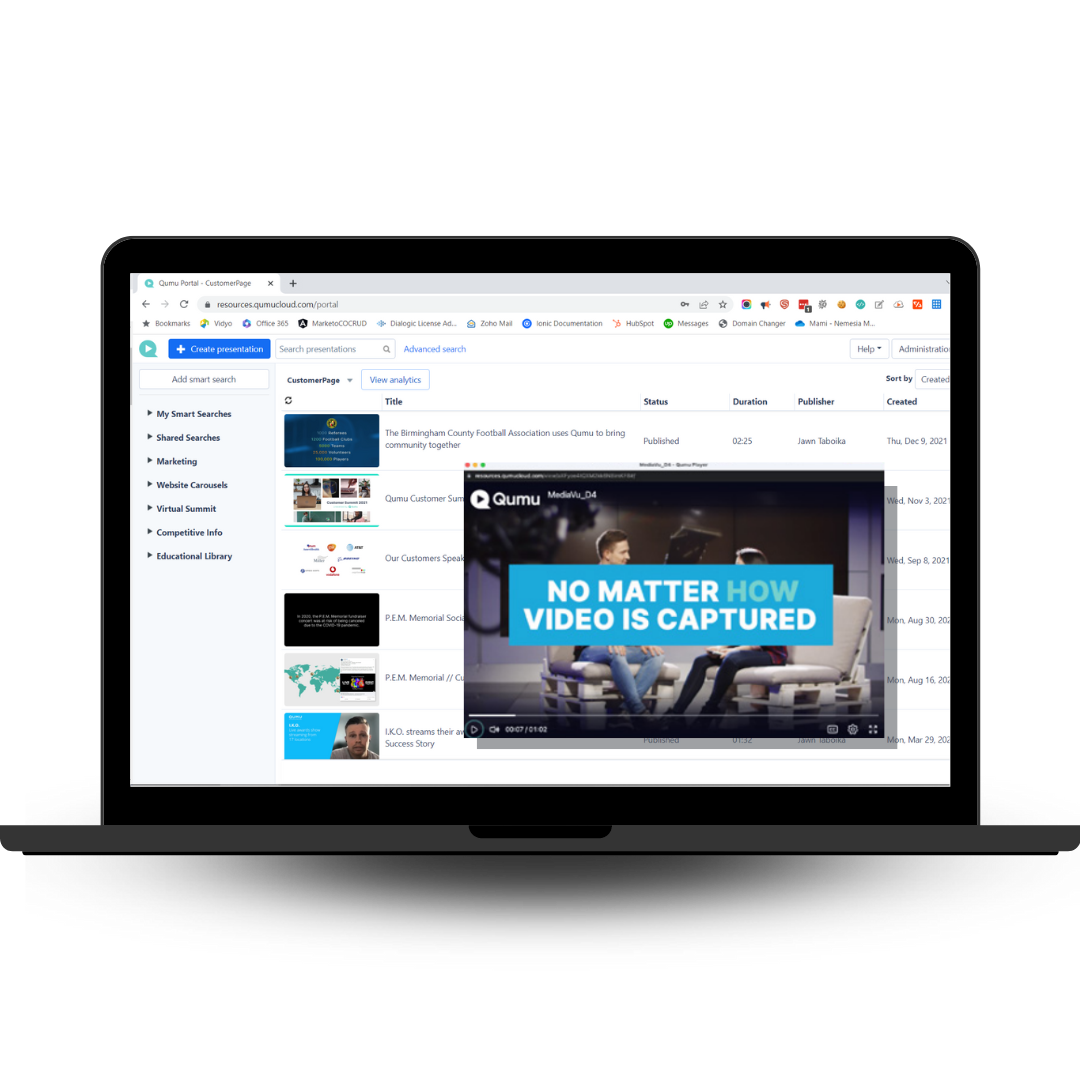

Centralize & Search

Centralize all your videos in customized Viewer Portals and provide to your audiences a direct access to relevant information they need thanks to smart searches.

Analyze Insights

Gain insights to make better decisions about video experience by analyzing your real-time network and viewer engagement data and measuring the relative performance of your content.

A Unique Video Solution for Your Industry

Financial Services - Banking

Qumu helps banks leverage the power of enterprise video management to improve customer engagement, streamline internal communication, and enhance training, events, townhalls and education programs while maintaining the highest standards of security and compliance.

Financial Services - Insurance

Financial Services - Investment

Simply reach your business objectives quickly using Qumu!

Video Solutions that enable and empower a Work Wherever, Whenever World.

Townhalls & Exec Comms

Product Launch

Crisis Communications

Customer Onboarding

Employee Onboarding

Top brands use Qumu for enterprise video

With Qumu, high-performing companies use smarter video to support secure video in the enterprise

Resources

See how Qumu clients of all sizes and industries are obtaining a competitive advantage using video. Gain insight, knowledge, and experience on what it takes to be successful with video in your organization.

How Smart Video Works

Get In Touch

Learn more about how Qumu’s solutions can power your enterprise.